Truckers, Heavy Vehicle Use Tax Return (Form 2290) Due September, 3.

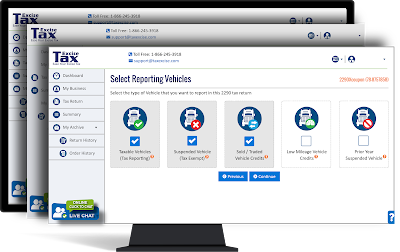

This is to remind truckers and other owners of heavy highway vehicles that, their next federal highway use tax return is due on Tuesday, September 3, 2019. Some taxpayers still opt to file their Form 2290 on paper, the IRS encourages all taxpayers to take advantage of the speed and convenience of filing this 2290 tax form electronically and paying tax dues electronically . Taxpayers reporting 25 or more vehicles must e-file their Form 2290 through an IRS-approved software provider like www.Tax2290.com . This year’s 2290 tax due date falls on September 3. Hence E-file ASAP to avoid last minute virtual Traffic jam. IRS will conduct its annual Labor Day power outage beginning Saturday, August 31, 2019, 9:00 p.m. and ending Tuesday, September 3, 2019, 7:00 a.m. (EST) . The IRS E-file system will not accept any return filed during this timeframe. If you are yet to file your Form 2290 for TY2019-20, we suggest you file before this shutdown to have your return processed