2290 Heavy Truck Tax Return Electronic Filing with Tax2290

The IRS Tax Form

2290 is used to report the annual federal heavy vehicle use tax

returns with the IRS. Tax Form

2290 can be electronically prepared and reported through TaxExcise.com. It is always easy, safe

and quick when you choose to file 2290 returns electronically, IRS as well will receive your returns process it faster and

issues you back the stamped Schedule-1 after accepting it.

You must file Form 2290 and Schedule 1 for the tax period beginning on July 1, and ending

on June 30, if a taxable highway motor vehicle needs to registered or renewed

under your name with the state authorities. Every truck operator may be an

individual, or a limited liability company (LLC), or a corporation, partnership

firm, or any other type of organization (including nonprofit, charitable,

educational, etc.) need to report 2290

Truck Tax Forms irrespective of reporting taxable or suspended

vehicles.

Here’s what you need to know:

·

If you have vehicles with a

gross weight of 55,000 pounds or more that travel 5,000 miles (7,500 miles for

a farm vehicle) or more annually on public highways, you must file IRS Form

2290 Heavy Vehicle Use Tax;

·

If you have 25 or more

vehicles that are 55,000 pounds or more, you must file electronically report

your 2290s;

·

You must have an Employer

Identification Number (EIN) to file Form

2290; you cannot use your Social Security Number or any.

·

You may choose Direct Debit

or Electronic Funds Withdrawal option or EFTPS to make your tax due with the

IRS.

·

IRS

stamped (watermarked) Schedule-1 would be shared with you

on the same day of filing, could be in 10 to 20 minutes from filing and once

accepted.

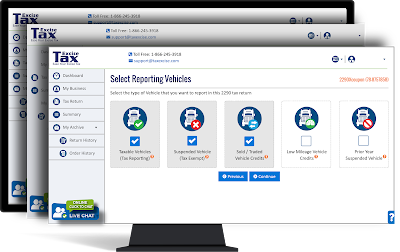

Electronic

Filing for 2290 Tax Reporting

Form 2290 and

Schedule -1 could be prepared and reported electronically with the IRS,

anyone who requires to file 2290s can use TaxExcise.com to file it

electronically. However IRS makes it mandate for fleet owners or vehicle

operates reporting 25 or more vehicles in a tax return. Electronic filing is

safe, secured and fast; quickest way of filing 2290

returns with the IRS.

Benefits of

Form 2290 Electronic Filing.

The foremost is

receiving back your IRS

stamped Schedule-1 proof instantly, IRS could receive your returns and

process it faster than any other way of filing. Choosing online filing or

electronic filing eliminated all possible human errors that could happen in a

tax return. Let see some of the larger benefits of e-filing with TaxExcise.com

·

Faster Processing

- e-filed returns are processed much faster than paper filed returns.

·

Proof of

Receipt - confirmation that your return was received and accepted, IRS

stamped Schedule-1 proof is sent to your mail inbox immediately.

·

FAX

copies – receive copies of your Schedule-1

to your FAX instantly and a copy to your email inbox.

·

Convenience

- available online 24 hours a day, 7 days a week. File your 2290 tax returns any time. File

amendments and correction on the same day, in less than an hour.

·

Ease of

use - user friendly, with step-by-step instructions and clear screens

indicators to walk you through the filing process. E-file is a cake-walk

·

Greater

Accuracy in Processing – zero down math errors because TaxExcise.com

software catches many mistakes and will not sent an incomplete return to IRS.

·

Pay Right

– while you e-file you pay the tax that you owe not extra or less.

·

Electronic

Payment - convenience of direct withdrawal of tax due and EFTPS option to

make payments.

·

Less Hassle,

No Mails - no mailing of paper returns and waiting for mails for weeks,

everything is managed electronically and digitally.

·

Security

- safer than mailing your tax return and sent right to the IRS server no more

data loss.

·

Avoid

paying extra – when you e-file you can make sure your return reaches them

well in the time frame no late penalties or late filing charges.

·

Import

tax return – you could import the tax returns from your previous years and

no need to look around for details in your files.

·

Bulk Upload

– when you file for larger fleets you can bulk upload the VIN# from your excel

spread sheet and no need of keying in one after the other.

·

No more

typos – while you e-file you won’t get typos such us 1 for I or 0 for o

etc.

Electronic filing is

by and large the best way of reporting 2290

heavy vehicle use tax returns with the IRS and through TaxExcise.com you

get the best available resources. The most trusted and rated website since

2007.