Get Ready to Pre EFile the 2290 Taxes for Tax Year 2021-22 today

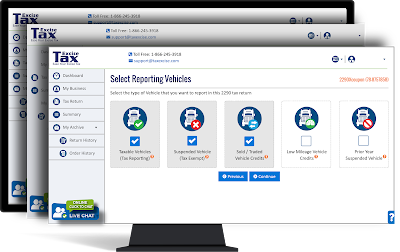

Pre-FILE TAX 2290 RETURNS FOR TAX YEAR 2021 - 22. Faster Processing – e-filed returns are processed much faster than paper filed returns Proof of Receipt – confirmation that your return was received and accepted, IRS stamped Schedule-1 proof is sent to your mail inbox immediately once IRS Accept it in first week of July, 2021. Instant Text Alert – Text Alert on return status once there is an update from IRS FAX copies – receive copies of your Schedule-1 to your FAX instantly and a copy to your email inbox. Convenience – available online 24 hours a day, 7 days a week. File your 2290 tax returns any time. File amendments & correction on the same day, in less than an hour. Ease of use – user friendly, with step-by-step instructions and clear screens indicators to walk you through the filing process. E-file is a cake-walk Greater Accuracy in Processing – zero down math errors because Tax2290.com software catches many mistakes and will not...